Information Disclosure Based on TCFD Recommendations

Our Group positions “Addressing Climate Change and Decarbonization” as one of our material priorities. We have long-term targets for reducing greenhouse gas emissions, and we are intensifying our efforts towards lowering our Group’s carbon footprint.

Based on the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD), to which we pledged our support in October 2021, we are conducting scenario analysis for our business covering the risks and opportunities related to climate change. At the same time, we are enhancing information disclosure about our initiatives for decarbonization.

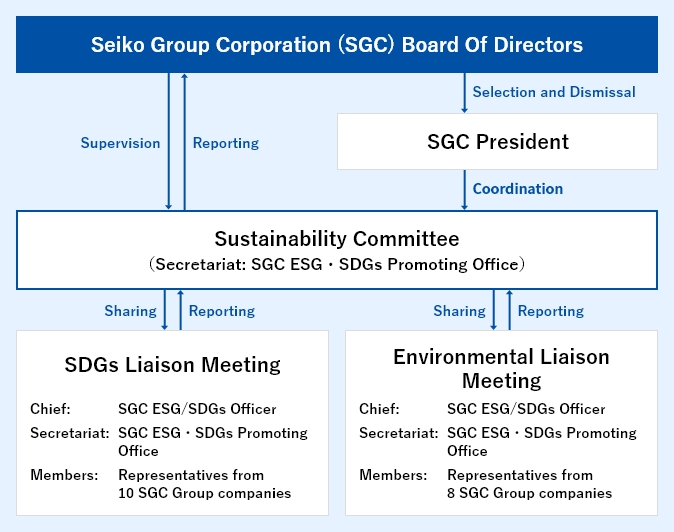

Governance

Important matters related to climate change, including climate-related risks and opportunities, are addressed by the Sustainability Committee, which was established for the purpose of formulating the Group's policies on sustainability and conducting activities related to those policies. The Sustainability Committee reports to the Board of Directors, which is responsible for overseeing the Committee, and which also regularly discusses matters related to climate change.

In addition, the rate of CO₂ emissions reduction is included as a “non-financial (ESG) assessment” in the performance evaluation index as a KPI for performance-linked executive compensation.

Promotion Structure

Roles

Board of Directors

The Board will receive reports on the Sustainability Committee’s resolutions at least once a year, and will oversee activities and progress on related issues. Additionally, it will hold regular discussions on matters of significance related to climate change.President(Climate Change Response Supervisor)

Important matters related to climate change are supervised by the President. The President serves as the chairman of the Sustainability Committee and is ultimately responsible for formulating the Group's sustainability-related policies, including matters related to climate change, and making decisions regarding all related activities.Sustainability Committee

The Committee is chaired by the President, who is in charge of climate change-related issues, as well as the presidents of all the Group companies. It also includes full-time officers, such as the Officer in Charge of Sustainability Promotion, who plays a key role in overseeing activities prescribed by the Sustainability Committee.Matters related to the Group's materiality, including those related to climate change, are addressed twice a year at regular meetings, and at extraordinary meetings when necessary, and the Committee’s decisions are reported to the Board of Directors.

Climate-related Board of Directors and Committee Meetings Held

As a general rule, material matters, including those related to climate change, are addressed by the Sustainability Committee twice a year, and their conclusions are reported to the Board of Directors at least once a year. The Seiko Group established the Sustainability Committee in September 2021, and since then, it has been actively discussing issues, making resolutions, and reporting those resolutions to the Board. The main climate-related matters decided are as follows:

| Month held | Main climate-related content + output | |

|---|---|---|

| Board of Directors | Nov. 2021 | Establishment of sustainability policy (Resolution) |

| Dec. 2021 | Establishment of long-term targets for reduction of greenhouse gas emissions (Report) | |

| Apr. 2022 | Key actions for materiality (Report) | |

| Jul. 2022 | Information disclosure based on TCFD recommendations (Report) | |

| Nov. 2022 | FY2021 Greenhouse Gas (GHG) Emissions (Report) | |

| Feb. 2023 | Information disclosure update based on TCFD recommendations (Report) | |

| Apr. 2023 | Plan to Introduce Renewable Energy is Ahead of Schedule (Report) | |

| Jul. 2023 | FY2022 GHG Emissions (Report) | |

| Nov. 2023 | Revision of Long-term Greenhouse Gas Emission Reduction Targets and Decarbonization Transition Plan (Report) | |

| Aug. 2024 | FY2023 GHG Emissions (Report) | |

| May. 2025 | Update Information Disclosure Based on TCFD Recommendations (Report) | |

| Sustainability Committee | Oct. 2021 | Key actions regarding materiality (Discussion) |

| Dec. 2021 | Establishment of long-term targets for reduction of greenhouse gas emissions (Discussion and Resolution) | |

| Mar. 2022 | Key actions regarding materiality (Discussion and Resolution) | |

| Jul. 2022 | Information disclosure update based on TCFD recommendations (Discussion and Resolution) | |

| Dec. 2022 | Decarbonization roadmap (including transition plan) (Discussion) | |

| Feb. 2023 | Information disclosure update based on TCFD recommendations (including decarbonization transition plan) (Discussion and Resolution) | |

| Mar. 2023 | Discussion and Resolution on the Accelerated Plan for the Introduction of Renewable Energy | |

| Jun. 2023 | FY2022 GHG Emissions (Report) | |

| Oct. 2023 | Discussion and Resolution on the Revision of Long-term Greenhouse Gas Emission Reduction Targets and Decarbonization Transition Plan | |

| Jul. 2024 | FY2023 GHG Emissions (Resolution) | |

| Nov. 2024 | How to Promote 100% Renewable Energy at Domestic Facilities in FY2024 (Report) | |

| May. 2025 | Update on Information Disclosure Based on TCFD Recommendations (Discussion and Resolution) |

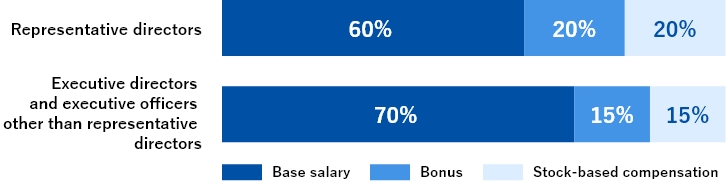

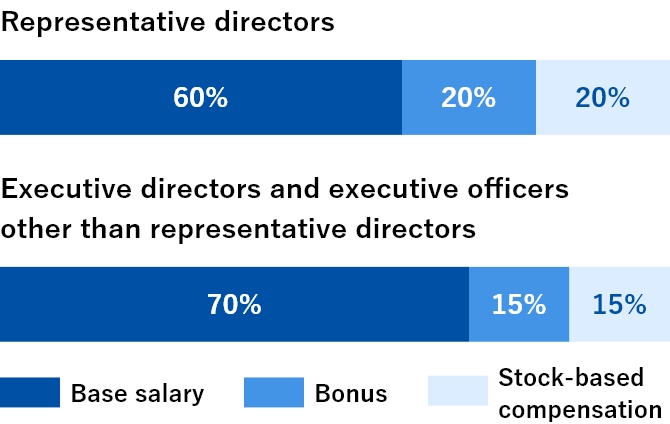

Performance-Linked Executive Compensation

Executive director and executive officer compensation consists of fixed compensation (basic remuneration), stock-based remuneration, and performance-linked bonuses, while compensation for outside directors and other non-executive directors consists only of basic remuneration. Performance-linked compensation is based on both financial indicators, such as consolidated operating income, consolidated gross profit margin, and consolidated ROIC, and two non-financial indicators: individual evaluation and ESG evaluation (based on CO₂ emissions reductions, etc.). The compensation for each position is determined by the Board of Directors after deliberation by the Corporate Governance Committee to ensure that the level of compensation provides appropriate incentive.

The approximate amount for each type of compensation is as stated below. (This assumes a performance-based payment rate and qualitative evaluation of 100%)

Performance-linked Compensation Metrics

| Performance indicators | |

|---|---|

| Bonus | ①Consolidated operating profit |

| ②Consolidated net sales margin | |

| ③Individual performance evaluation | |

| Stock-based compensation | ①Consolidated operating profit |

| ②Consolidated net sales margin | |

| ③Consolidated ROIC | |

| ④ESG assessment: CO₂emissions reduction rate (SCOPE1,2), etc. |

Strategy

Scenario analysis process

We evaluate the financial and business impacts of climate-related risks and opportunities on the Group under different scenarios, and conduct scenario analysis with the aim of enhancing the Group’s resilience. The main scenario has been revised from a projection of less than 2℃ total global temperature rise to a scenario of a 1.5℃ rise.

Scope

This applies to all Group businesses and the entire value chain, including upstream and downstream, both in Japan and overseas

Reference Scenario

| Classification | Scenario Overview | Main Reference Scenario |

|---|---|---|

| 1.5℃ Scenario | A scenario in which multiple nations implement policies and regulations to achieve a decarbonized society, and the global temperature increase above pre-industrial levels is limited to 1.5℃. The transition risk is high, but the physical risk is lower than in the 4℃ scenario. | ・IEA World Energy Outlook 2024 Net Zero Emissions by 2050 Scenario ・IPCC SSP1-1.9 |

| 4℃ Scenario | A scenario in which no new policies and regulations are introduced, and global energy-derived CO₂ emissions continue to increase. Compared to the 1.5℃ scenario, the transition risk is low, but the physical risk is high. | ・IEA World Energy Outlook 2024 Stated Policy Scenario ・IPCC RCP8.5/SSP5-8.5 |

Scenario Analysis Steps

-

STEP 1 Identification of significant climate-related risks/

opportunities and establishment of parameters- Identify climate-related risks and opportunities

- Assess high significance risks/opportunities

- Set parameters related to highly significant risks/opportunities

-

STEP 2 Setting climate-related scenarios

- Based on the information in STEP 1, etc., identify scenarios that are closely related to the existing scenarios

- Establish climate-related scenarios (social vision)

-

STEP 3 Assessment of financial

impact for each scenario- Analyze the financial impact of each scenario based on the scenarios established in STEP 2 and the key climate-related risks/opportunities and related parameters identified in STEP 1

-

STEP 4 Assessment of the resilience of the strategy to climate-related risks and opportunities and further measures to address them

- Assess the resilience of our strategy to climate-related risks and opportunities

- Consider further response measures

Business impact associated with climate-related risks and opportunities and the Group's response

We have conducted scenario analysis covering all Group businesses, and assessed key risks and opportunities. Based on this review, we are formulating and implementing measures to address these risks.

Climate-related risk

| Risk category | Risk description | Business impact (2030)*1 | Our Group's response | |||

|---|---|---|---|---|---|---|

| 1.5℃ Scenario | 4℃ Scenario | |||||

| Risk | Transition risk | Policy & regulation | Increased costs due to introduction and strengthening of carbon tax | 850 million yen*2 Medium |

480 million yen*2 Medium |

|

| Market | Decreased sales due to inability to respond to requests from suppliers for climate-related measures | Medium | Medium |

|

||

| Increased procurement costs due to higher raw material prices | Small | Small |

|

|||

| Physical risk | Urgent | Decline in sales due to supply chain disruptions and logistics delays due to abnormal weather | Small | Medium |

|

|

| Decline in sales due to interruption of plant and store operations due to abnormal weather and difficulties in securing personnel | Medium | Large | ||||

| Chronic | Rising loss premiums due to increase in extreme weather conditions | Medium | Medium | |||

Climate-related opportunities

| Opportunity category | Opportunity description | Business impact (2030) *1 | Our Group's response | ||

|---|---|---|---|---|---|

| 1.5℃ scenario | 4℃ scenario | ||||

| Opportunity | Energy source | Cost reduction by introducing renewable energy | Small | Small |

|

| Products and services | Increased sales of low-power- consumption compatible products due to expansion of CPS/IoT society | Medium | Medium |

|

|

| Increased sales of related parts to automobile sector due to ongoing shift to EVs | Medium | Medium |

|

||

| Increased sales of low-carbon products and services that can help customers reduce their environmental impact | Large | Medium |

|

||

| Increased sales of products that respond to consumers' growing environmental awareness | Small | Small |

|

||

| Market | Increased sales due to improved brand value through decarbonized management | Medium | Small |

|

|

- Large business impact: Extremely significant impact on business, such as an impact on profits of 1 billion yen or more, withdrawal from a business, or an interruption of business for several months or more.

Medium business impact: Significant impact on business, such as a profit impact of between 100 million yen and 1 billion yen, negative impact on business plans, downsizing of a business, or a business interruption of one week to one month.

Small business impact: Minor or negligible impact on business, such as a profit impact of less than 100 million yen, little or no impact on business plans, or little or no interruption of business. - GHG emissions for 2030 (Scope 1 and 2) are calculated based on current growth projections and GHG reduction plans, and are multiplied by the IEA carbon price for both the 1.5℃ and 4℃ scenarios. (Exchange rate 1$=145JPY)

Resilience Assessment

By doing this scenario analysis, we were able to foresee the Group's resilience during the transition to a decarbonized society.

We will continue to promote strenuous efforts to cope with and ameliorate climate change.

We will also keep promoting strategic initiatives to further enhance our resilience to the impact of the business transition that we must carry out.

Risk Management

In order to centrally manage risks that could have a significant impact on the Group's business, the Seiko Group Risk Management Committee, chaired by the President of the Seiko Group, plays a central role in developing and strengthening Group-wide risk management. In addition, in order to promote risk management through close cooperation between Seiko Group Corporation (SGC) and its various Group companies, SGC established a Group Risk Management Committee comprised of the presidents of each Group company, and also established a system to identify and share information about risks that could affect the Group.

In order to conduct a more detailed analysis of climate-related risks, the Sustainability Committee uses scenario analysis to identify and evaluate high-impact climate-related risks at Group companies. It also makes resolutions and suggests countermeasures, which it promotes through cooperation with the Group companies. The content of resolutions is reported to the Board of Directors and the Company's Risk Management Committee.

Group Risk Management Promotion Structure

Roles

Seiko Group Risk Management Committee *1

Chaired by the President, the Seiko Group Risk Management Committee focuses on risks that need to be addressed across the Group. The Committee also receives reports from risk owners at the Company and at Group companies, and supports the promotion of risk management at each company.Group Risk Management Committee *2

This Committee, which is comprised of full-time officers and presidents of Group companies, identifies risks across the entire Group, monitors responses to the most important risks, and shares relevant information with Group firms.Risk Management Committee of Each Group Company *3

Each Group company promotes risk management autonomously, led by its own Risk Management Committee.Sustainability Committee

The Seiko Group discusses and determines policy on matters related to the Group's materiality, including climate-related risks, and reports the details to the Board of Directors and the Seiko Group Risk Management Committee.

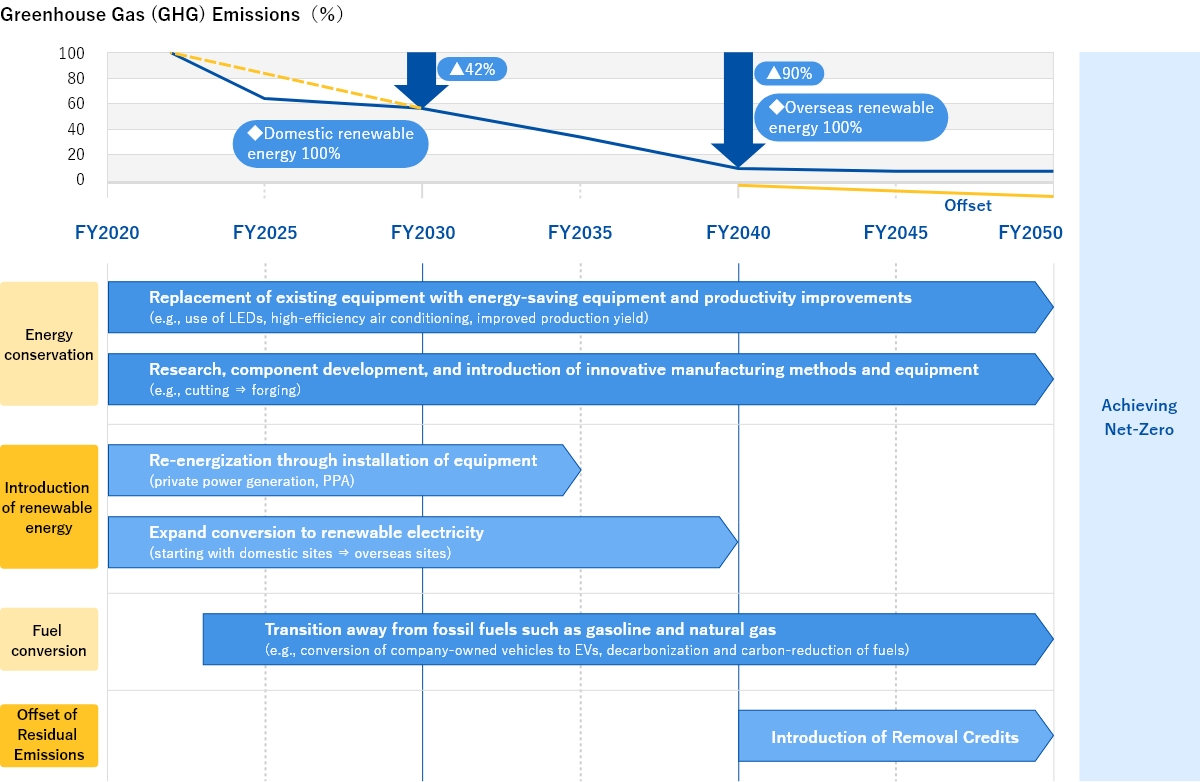

Metrics and Targets

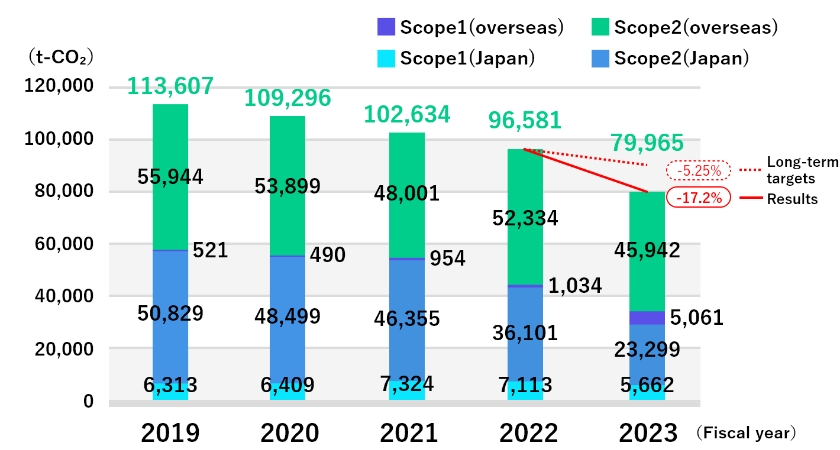

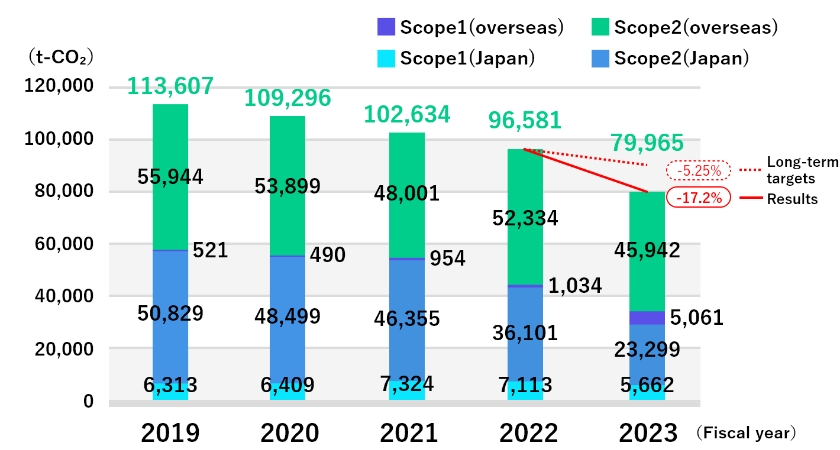

In November 2023, the Group revised its long-term target and has been strategically reducing GHG emissions from its domestic bases. In line with our long-term goals, we will continue to accelerate the introduction of renewable energy at our overseas bases and strive to further reduce GHG emissions.

Our FY2030 target has been certified as consistent with the 1.5℃ level set by the Paris Agreement. The SBT certification was presented by the Science Based Targets initiative (SBTi).

Long-Term Targets for Greenhouse Gas Emissions Reduction

Greenhouse gas emissions reduction target

Fiscal Year 2030

Scope1, 242% reduction compared to the FY2022 level.

Scope325% reduction compared to the FY2022 level, targeting categories 1 and 11.

Fiscal year 2050

Aiming for net zero.

Decarbonization Transition Plan (Scope 1, 2)

In November 2023, the Seiko Group revised its decarbonization roadmap to align it with our updated long-term targets for reducing greenhouse gas emissions. The Group continues to make progress in energy efficiency by updating existing facilities with energy-efficient equipment, enhancing productivity, and by investigating, developing, and implementing energy-efficient manufacturing methods and devices.

As a result, we finished converting all of our domestic bases to renewable energy during FY2024. We plan to achieve 100% renewable energy at all our overseas bases as well by the end of fiscal 2040. The Group aims to switch from fossil fuels to decarbonized or low-carbon alternative fuels. The residual emissions will be offset through the introduction of removal credits, with the aim of achieving net-zero emissions by fiscal year 2050.

Scope 1 and 2 Greenhouse Gas (GHG) Emissions FY2019~FY2023

In FY2023, our greenhouse gas emissions amounted to 79,965 t-CO₂, achieving a reduction of 17.2% compared to FY2022. This surpassed our target of 5.25%, which is the amount necessary to achieve our long-term target.* This achievement was largely due to ongoing energy-saving activities and the introduction of renewable energy.The ratio of renewable energy power reached 18.9%.

*In November 2023, we revised our long-term goals. Previously, the goal was to reduce by 42% compared to 2020 by 2030. After the revision, the goal is to reduce by 42% compared to 2022 by the fiscal year 2030, setting a higher target.

- Scope 1: Direct emissions by the business operator (e.g., fuel combustion)

- Scope 2: Indirect emissions from the use of electricity supplied by other companies (market-based)

- ■Scope of Data Aggregation:

- ・Seiko Group Corporation and all its Group companies

・Includes greenhouse gases other than CO₂

・Excludes biogenic GHG emissions - ■Emission Factors:

-

- ・Electricity:

- Japan sites: Use "Emission Factors by Electric Power Company" from the government’s Act on Promoting Global Warming Countermeasures

Overseas sites: Use the emission factors of each country based on data from the International Energy Agency (IEA)

- ・Fuel: Uses the "Calculation Methods and Emission Factors List" from the Act on Promoting Global Warming Countermeasures

- ・Greenhouse gases other than CO₂: ・Uses the "Calculation Methods and Emission Factors List" from the Act on Promoting Global Warming Countermeasures

Note: Due to rounding, the total GHG emissions and the sum of the individual numbers may not match.

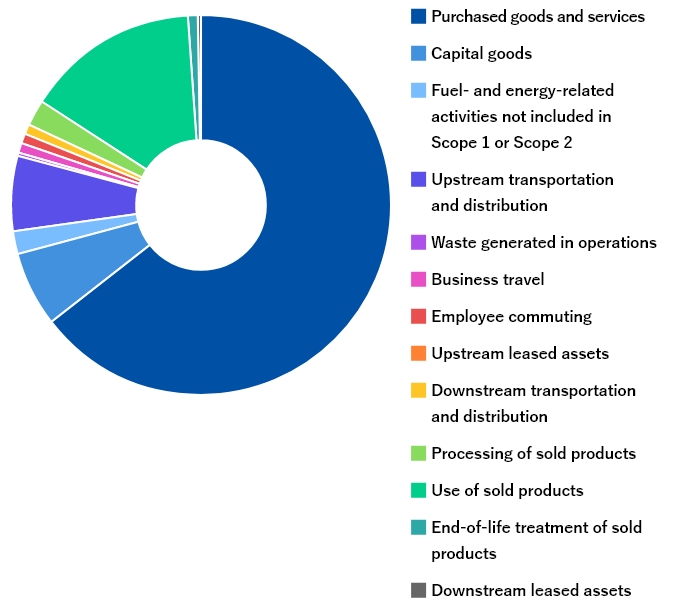

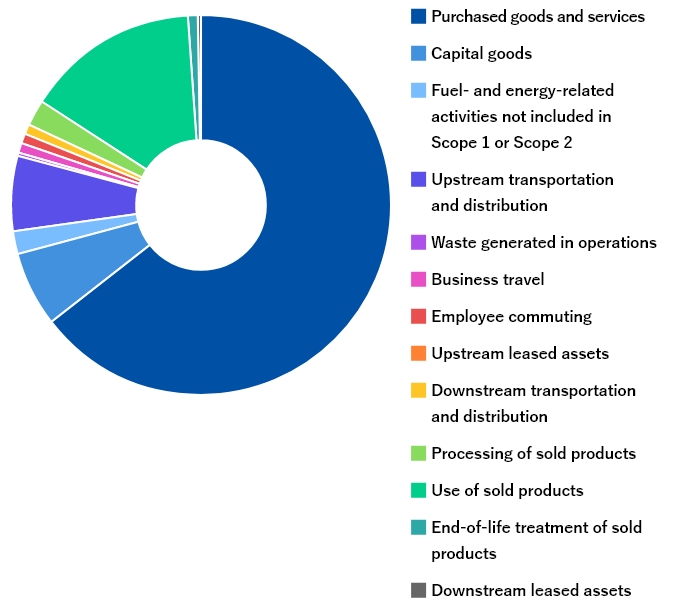

Scope 3 Greenhouse Gas (GHG) Emissions FY2023

The Scope 3 emissions amounted to 568,674 t-CO₂. Among the categories, the purchase of products and services (Category 1) accounted for approximately 64%, and the use of sold products (Category 11) constituted around 15%, ranking as the top contributors to Scope 3 emissions.

| Category | Item | GHG emissions (t-CO₂) |

% |

|---|---|---|---|

| Category 1 | Purchased goods and services | 366,505 | 64.4% |

| Category 2 | Capital goods | 36,082 | 6.3% |

| Category 3 | Fuel- and energy-related activities not included in Scope 1 or Scope 2 | 12,399 | 2.2% |

| Category 4 | Upstream transportation and distribution | 35,093 | 6.2% |

| Category 5 | Waste generated in operations | 2,464 | 0.4% |

| Category 6 | Business travel | 4,506 | 0.8% |

| Category 7 | Employee commuting | 5,380 | 0.9% |

| Category 8 | Upstream leased assets | 122 | 0.0% |

| Category 9 | Downstream transportation and distribution | 3,476 | 0.6% |

| Category 10 | Processing of sold products | 12,469 | 2.2% |

| Category 11 | Use of sold products | 84,896 | 14.9% |

| Category 12 | End-of-life treatment of sold products | 4,573 | 0.8% |

| Category 13 | Downstream leased assets | 708 | 0.1% |

| Category 14 | Franchises | - | - |

| Category 15 | Investments | - | - |

| total | 568,674 | 100.0% |

*The total amount may not match due to the processing of fractions.