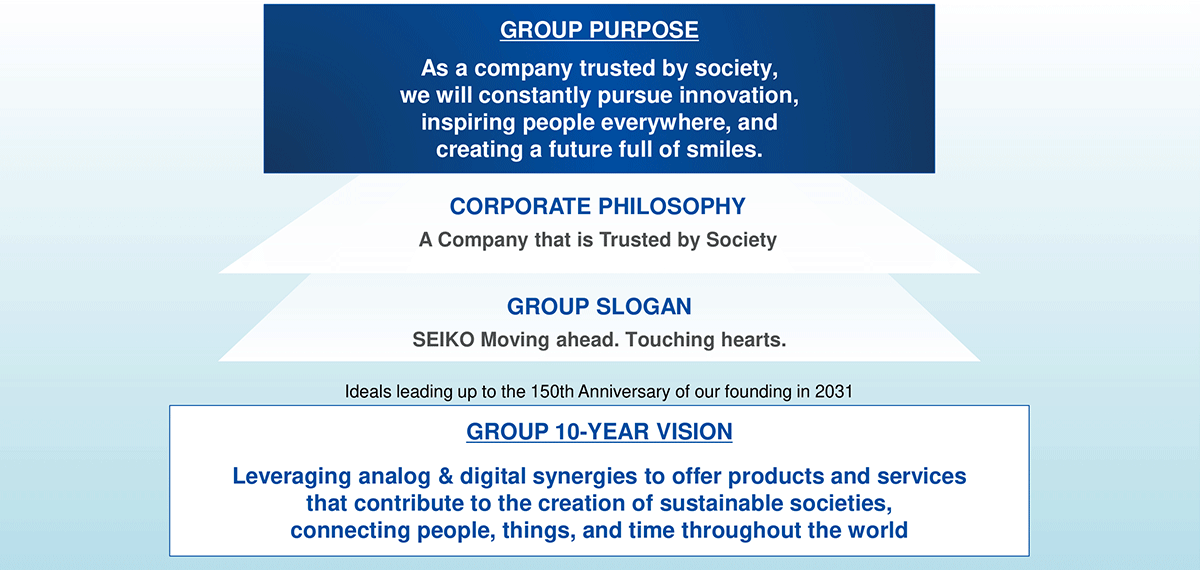

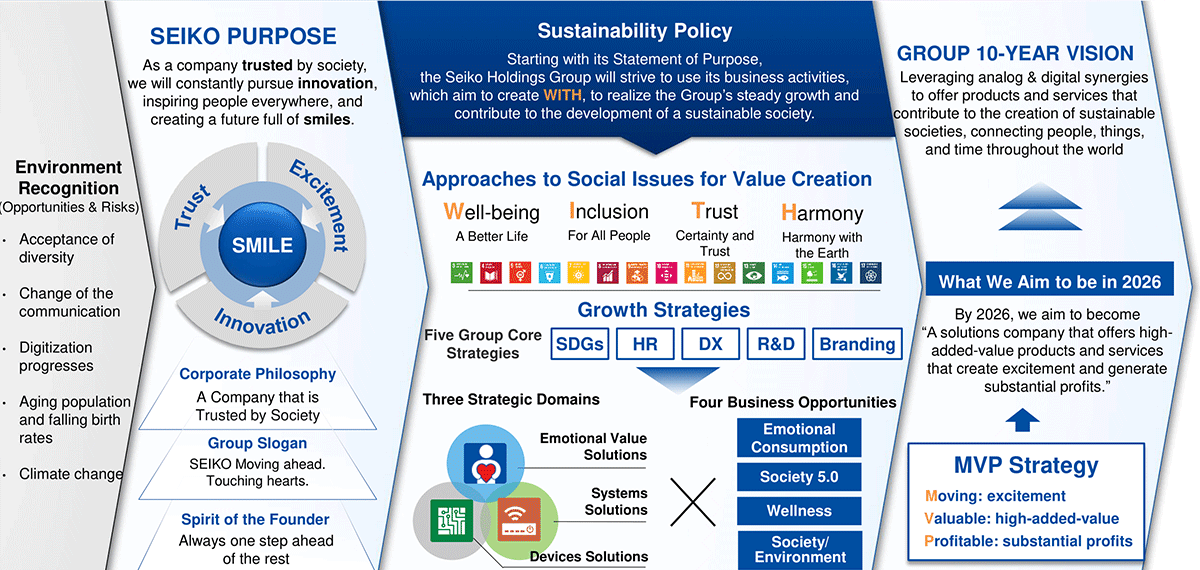

Group Purpose and Group 10-year vision

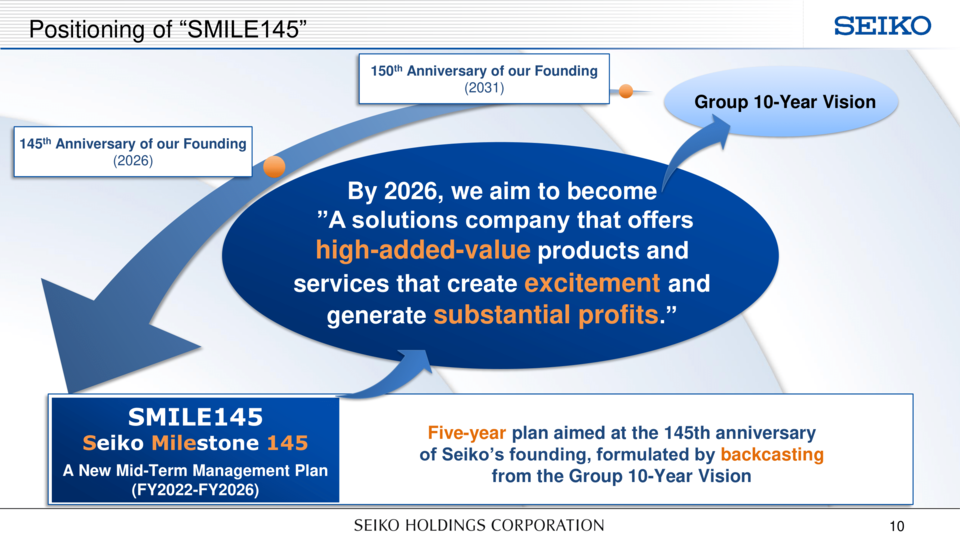

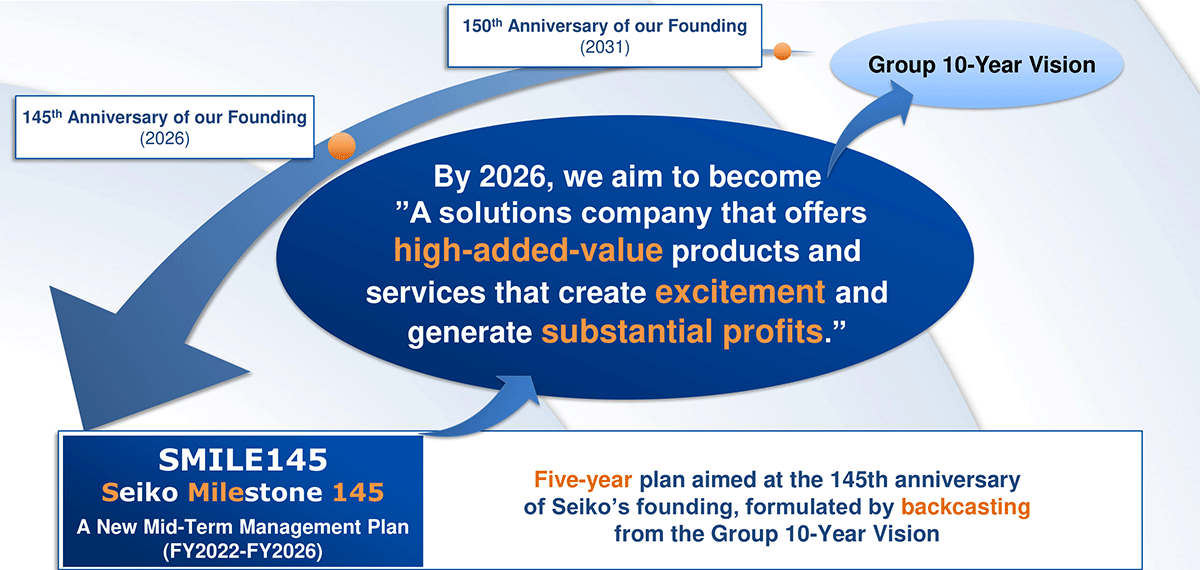

Positioning of “SMILE145”

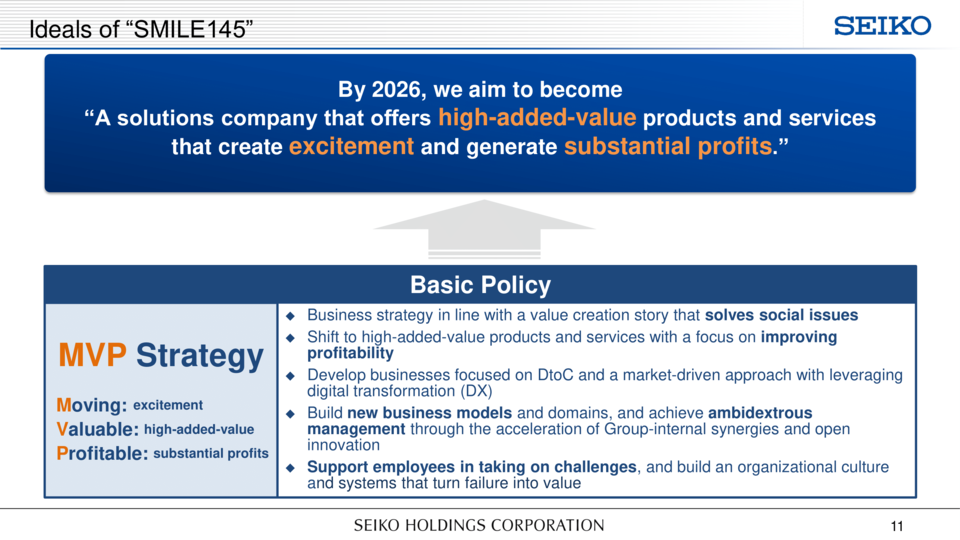

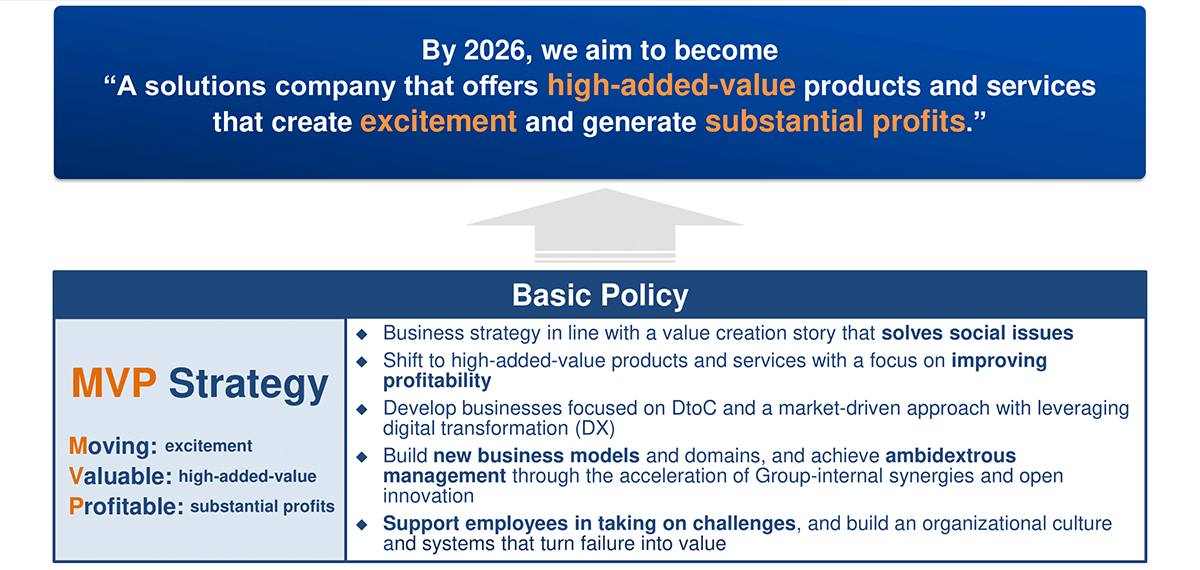

Ideals of “SMILE145”

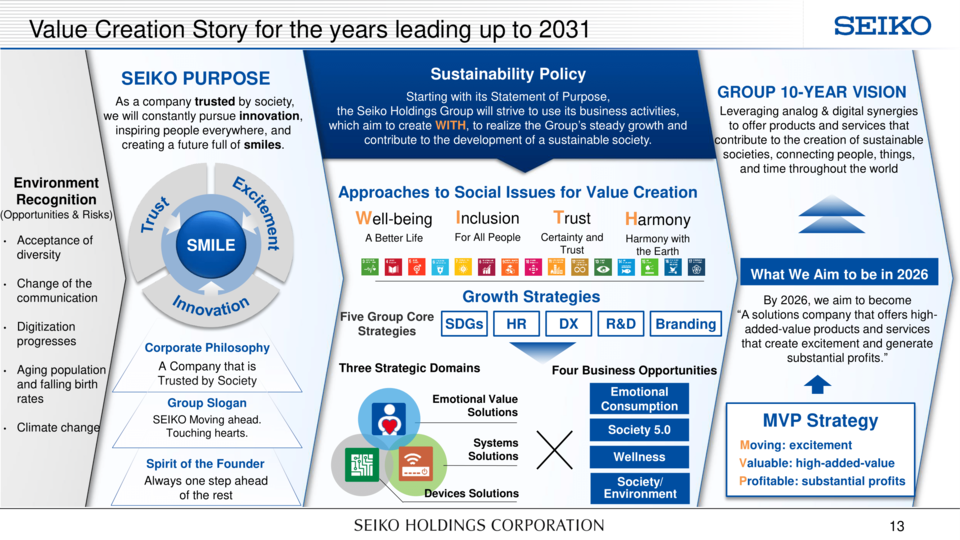

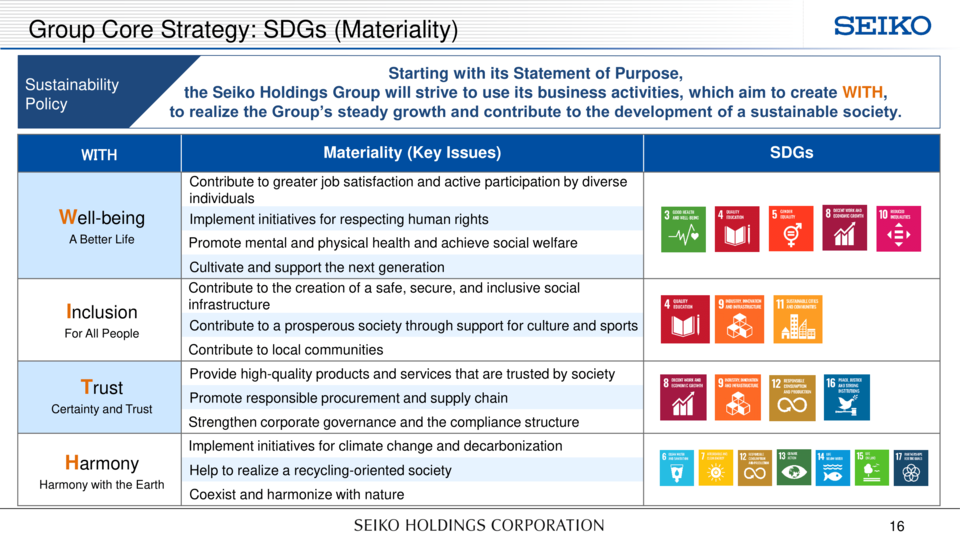

Value Creation Story for the years leading up to 2031

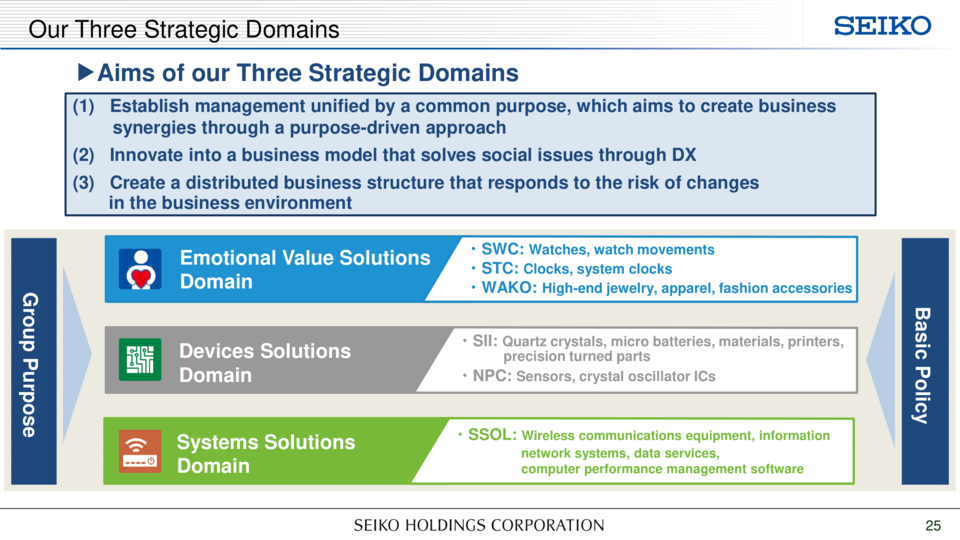

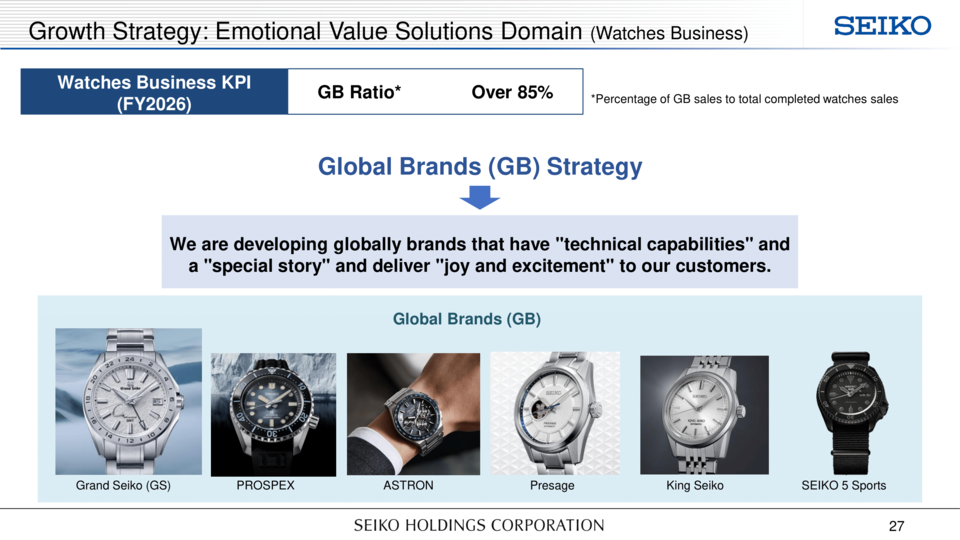

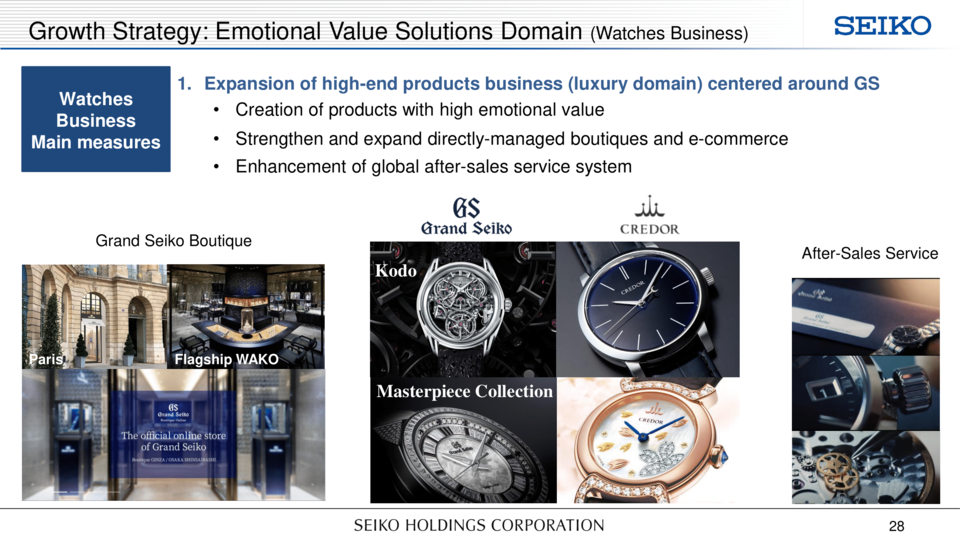

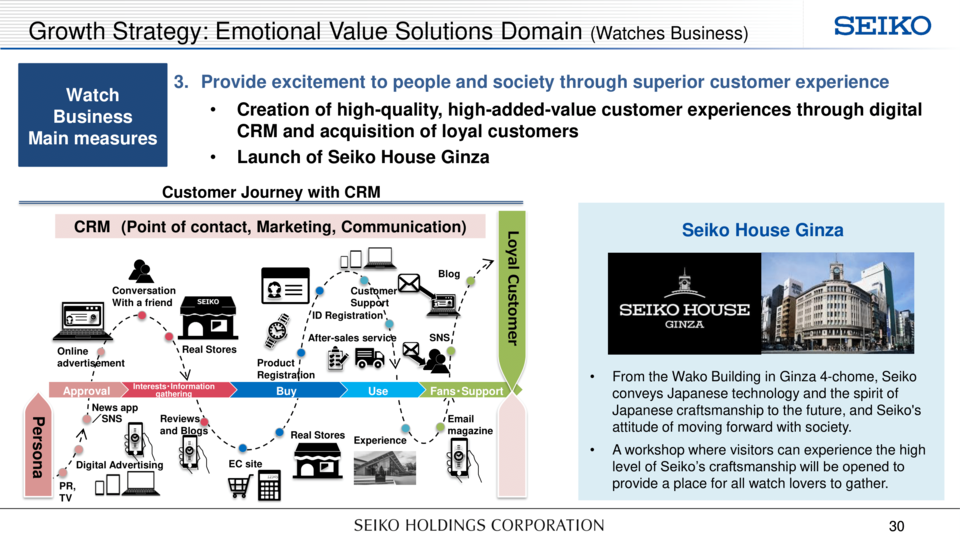

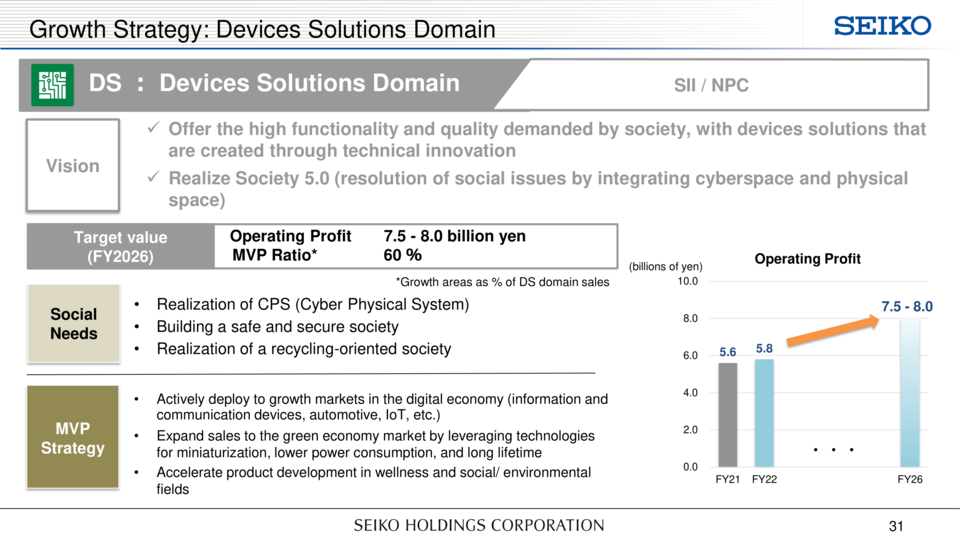

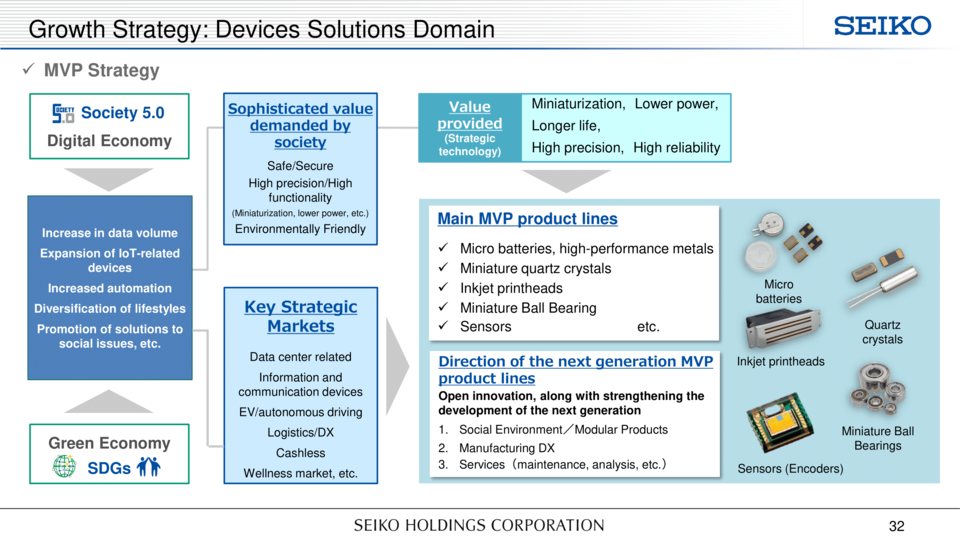

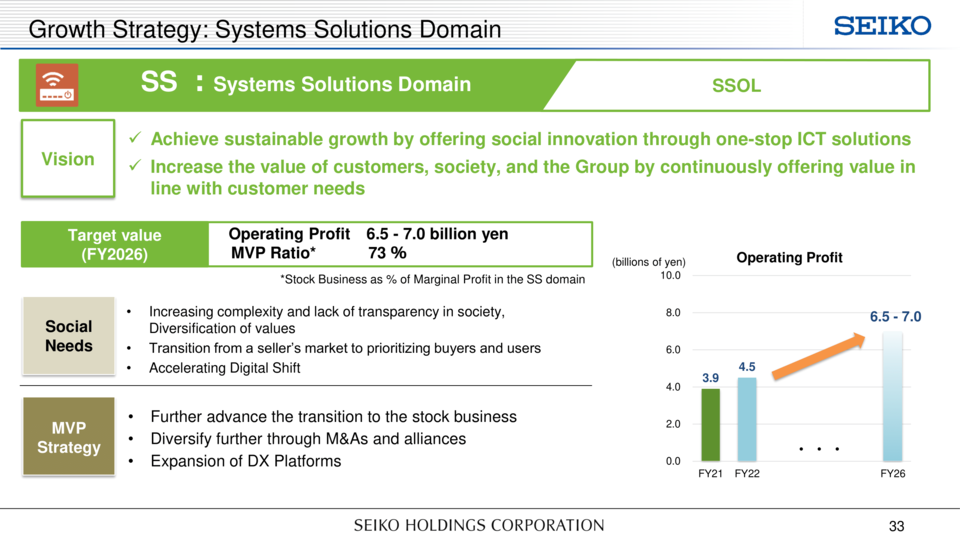

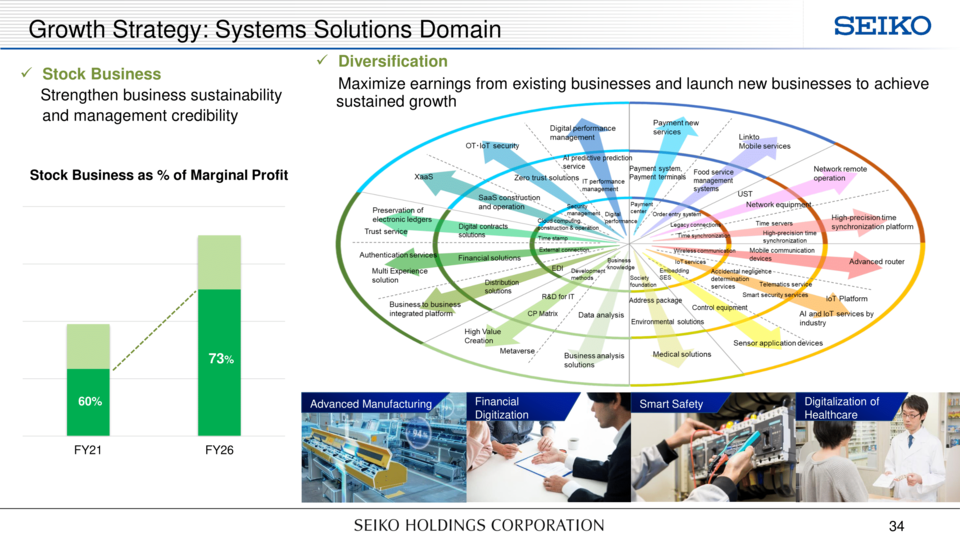

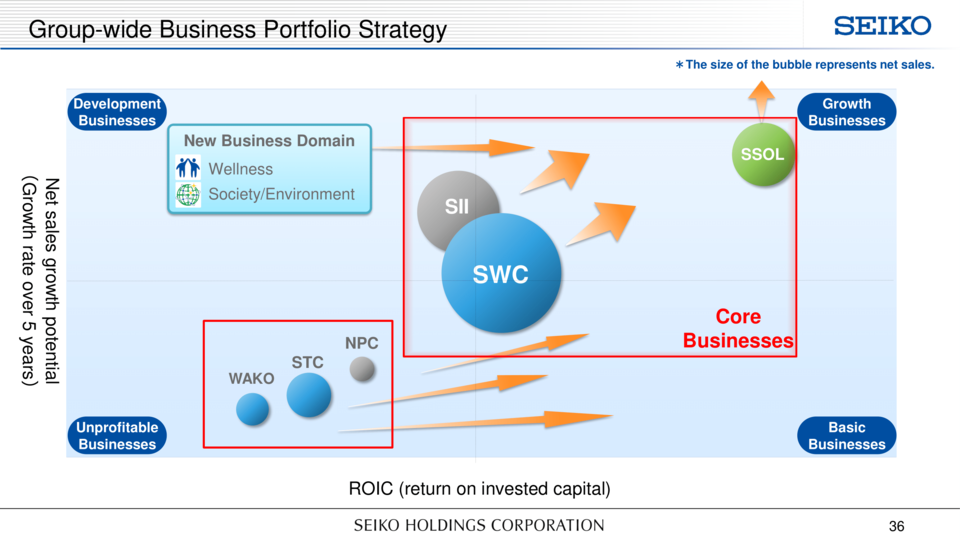

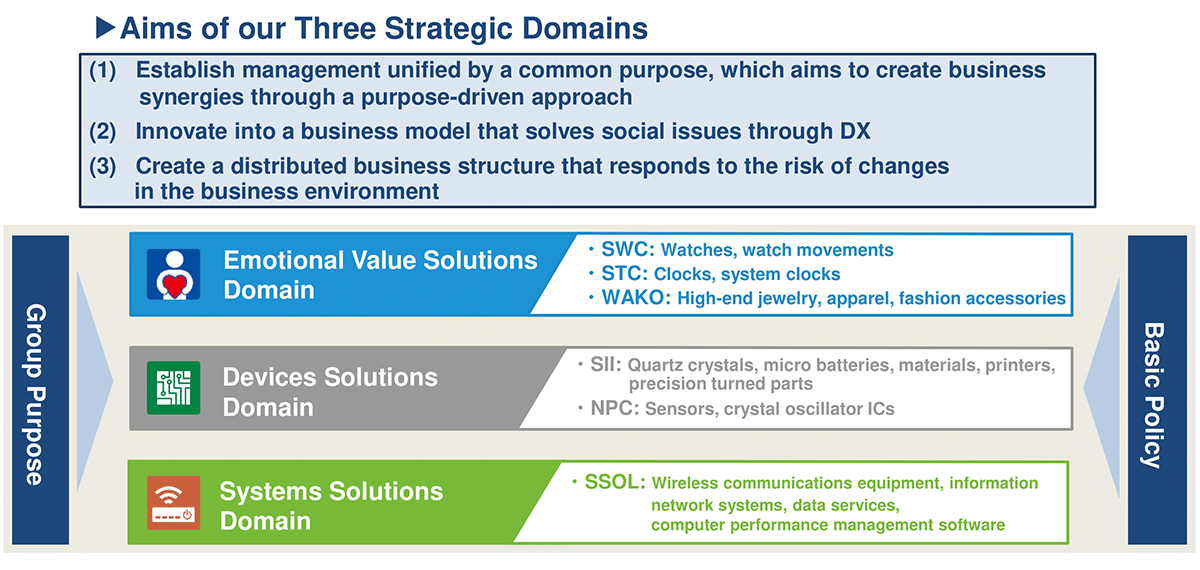

Our Three Strategic Domains

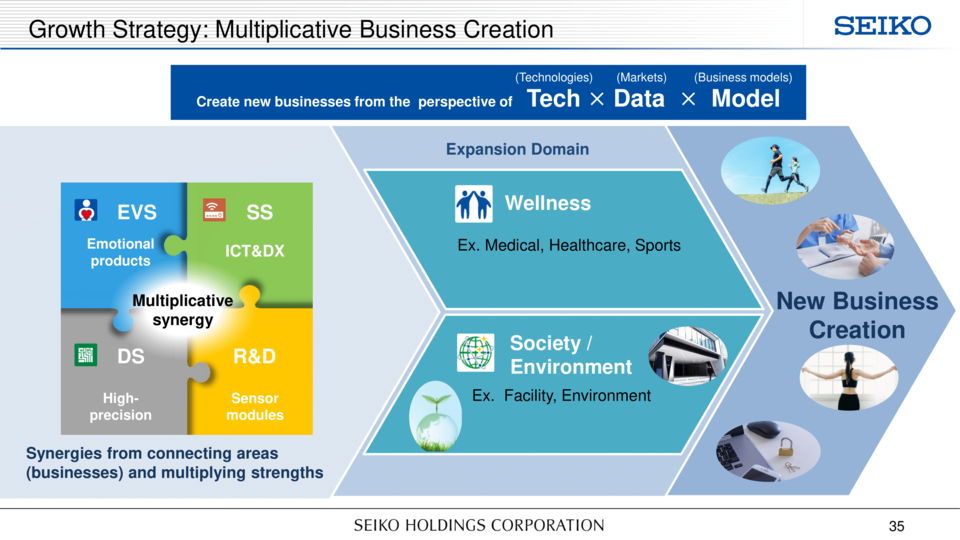

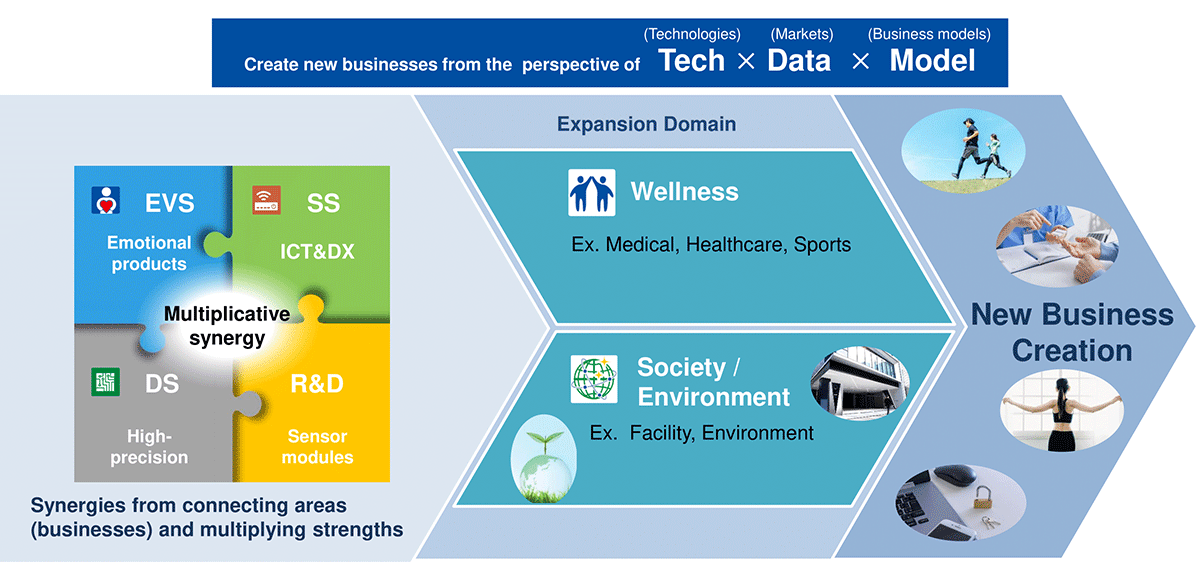

Multiplicative Business Creation

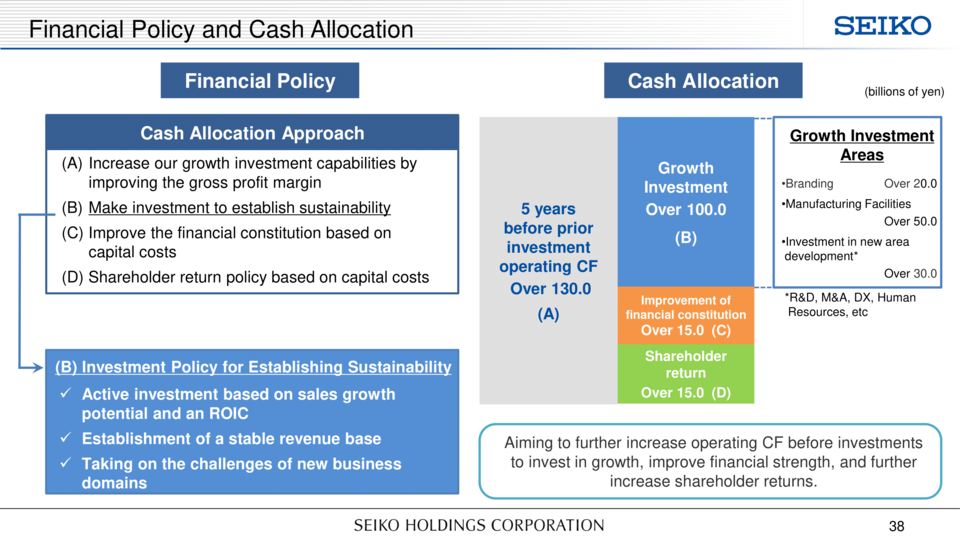

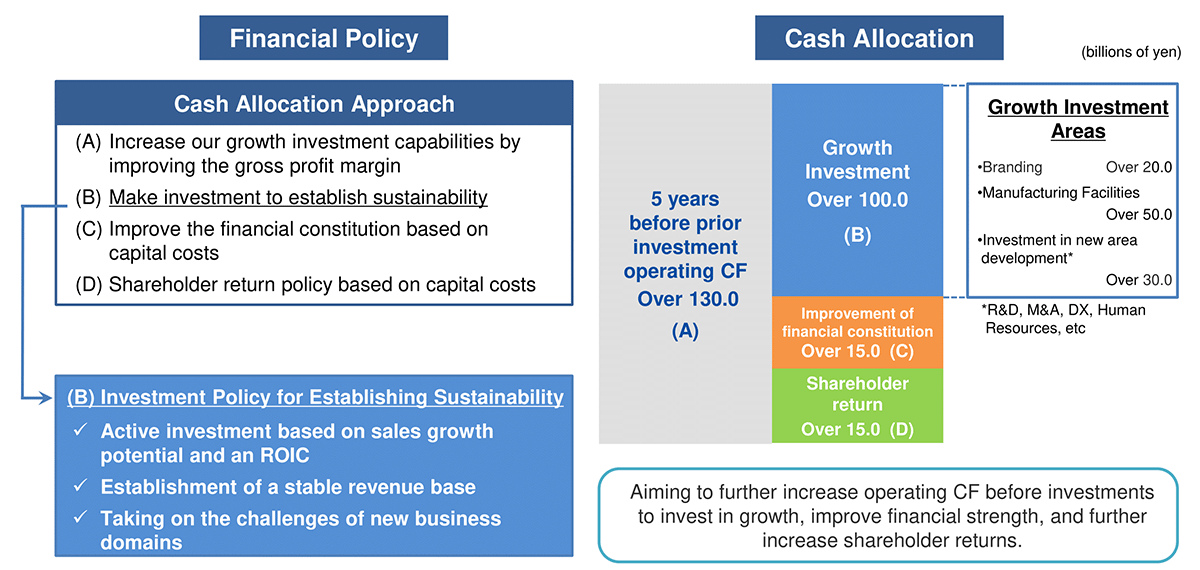

Financial Policy and Cash Allocation

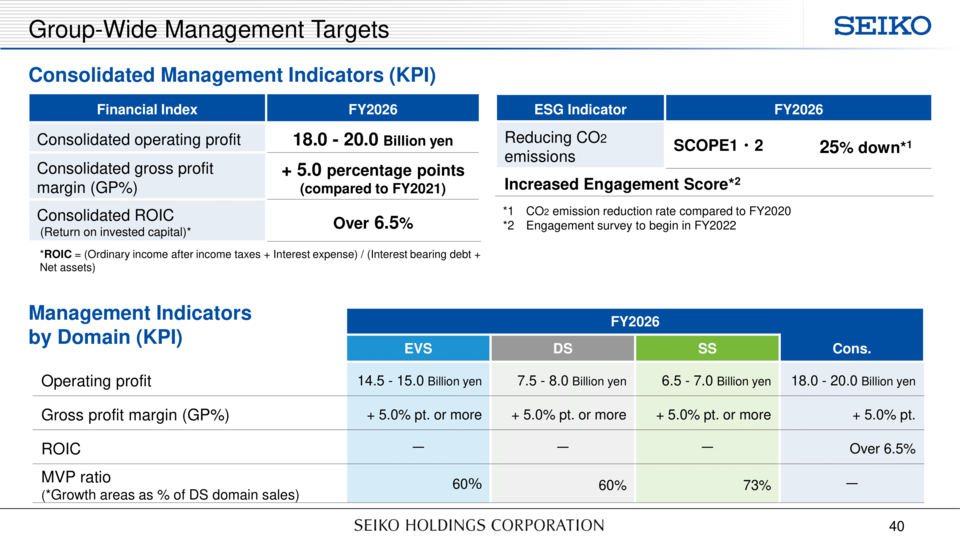

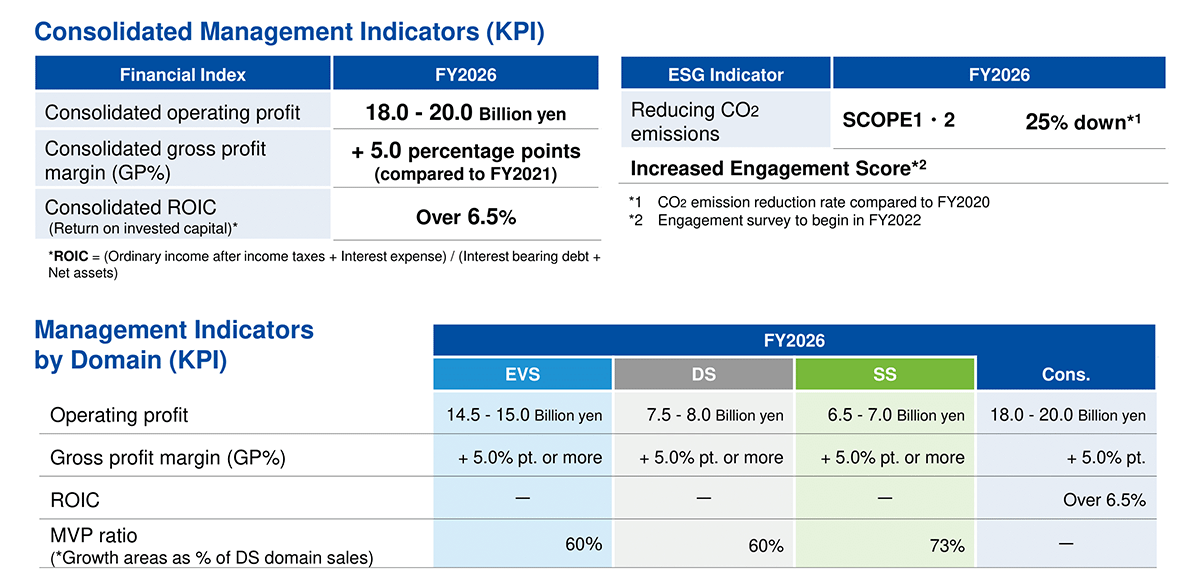

Group-Wide Management Targets

Mid-Term Management Plan documents

Details of the Mid-term Management Plan (FY2022-FY2026) are available in the PDF file below.

Related Links

- Management Policies

- Corporate Philosophy※

- Mid-Term Management Plan

- Corporate Governance

- Business Risks

* to Corporate Philosophy page in "About Our Group" section