- Basic Principle of Corporate Governance

- Basic Policies

- Basic Policies on Constructive Dialogue with Shareholders

- Corporate Governance Structure

- Evaluation of the Effectiveness of the Board of Directors

- Support system for Directors and Audit & Supervisory Board Member

- Compensation for Officers

- Appointment and Dismissal of Senior Management and Nomination of Candidates for Directors and Audit & Supervisory Board Member

- Cross-Shareholdings

- Internal Control System

Basic Principle of Corporate Governance

Based on the principle "being a company that is trusted by society", Seiko Group Corporation considers "compliance with relevant laws and regulations", "implementation of management transparency and fairness", and "honoring social ethics" as core business goals. In order to achieve these goals, we will strengthen and promote our corporate governance framework and strive to achieve our group’s sustainable growth and increase corporate value.

Basic Policies

(1) Securing the Rights and Equal Treatment of Shareholders

We strive to develop a necessary environment that effectively ensures the rights of shareholders including voting rights at the general meeting of shareholders, and provide them with necessary information accurately so that they can exercise their rights appropriately. We are also committed to securing equality among shareholders, such as minority shareholders and foreign shareholders.

(2) Appropriate Cooperation with Stakeholders other than Shareholders

We recognize that our social responsibility is to contribute to the realization of a sustainable society through implementation of our group's basic principle "being a company that is trusted by society". Under such recognition, we strive to cooperate appropriately with our various stakeholders, including our shareholders, customers, business partners, members of local communities and employees.

(3) Ensuring Appropriate Information Disclosure and Transparency

In order to obtain appropriate evaluation from our various stakeholders including our shareholders, and to engage in a constructive dialogue with shareholders, we strive not only to disclose appropriate information in compliance with relevant laws and regulations, but also to disclose other information in a timely and appropriate manner so that such information would be clear and useful for the people who use it.

(4) Responsibilities of the Board of Directors

Our Board of Directors will engage in free and constructive discussions and exchanges of opinions, and will appropriately fulfill its roles and responsibilities for the sustainable growth of company and the enhancement of corporate value over the medium to long-term, including making decisions on important management matters such as business strategies, establishing an environment that supports swift and decisive decision-making by the senior management, and enhancing management supervision.

(5) Dialogue with Shareholders

We will promote constructive dialogue with our shareholders to contribute sustainable growth and enhancement of corporate value over the medium to long-term based on "Basic Policy on Constructive Dialogue with Shareholders".

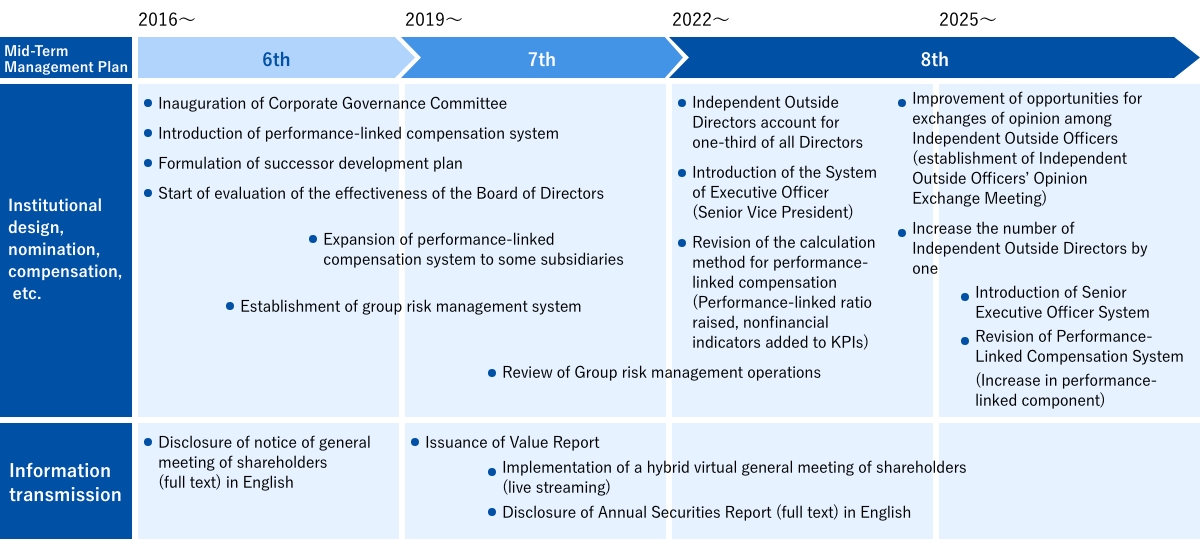

Initiatives to Strengthen Corporate Governance

Basic Policies on Constructive Dialogue with Shareholders

Seiko Group Corporation (the "Company") promotes constructive dialogue with its shareholders and investors (the "Shareholders") so as to support sustainable growth and increase corporate value over the medium to long-term based on the following policies:

- President of the Company supervises efforts toward realization of constructive dialogue with the Shareholders, and Directors in charge of IR and General Affairs promote such efforts.

- IR Department and General Affairs Department shall be responsible for sharing information periodically with associated departments such as Accounting and Public Relations Departments in order to promote constructive dialogue with the Shareholders.

-

In addition to holding regular meetings, as a means for communication with the Shareholders, the Company strives to enhance dialogue with the Shareholders by implementing following measures.

- The Company regards general meeting of shareholders as an important opportunity for dialogue with the Shareholders. The Company shall make clear information disclosure when delivering notice of ordinary general meeting of shareholders and shall provide comprehensive answers and explanations in response to questions raised by the Shareholders at the meetings.

- The Company participates in IR conferences held by securities companies and hold meetings for analysts to explain its mid-term management plan, progress of such plan, the financial results of the Company, and the status of its overall business activities.

- The Company strives to enhance information disclosure to the Shareholders on its website, in its notice of the general meeting of shareholders, and in its annual reports published to the Shareholders.

- IR Department and General Affairs Department shall periodically report opinions, evaluations and questions received from the Shareholders to management meetings, and share such information with the senior management of the Company.

- In a dialogue with the Shareholders, the Company shall manage insider information appropriately according to its Prevention of Insider Trading Rules and disclose information in a fair manner in accordance with its IR policy.

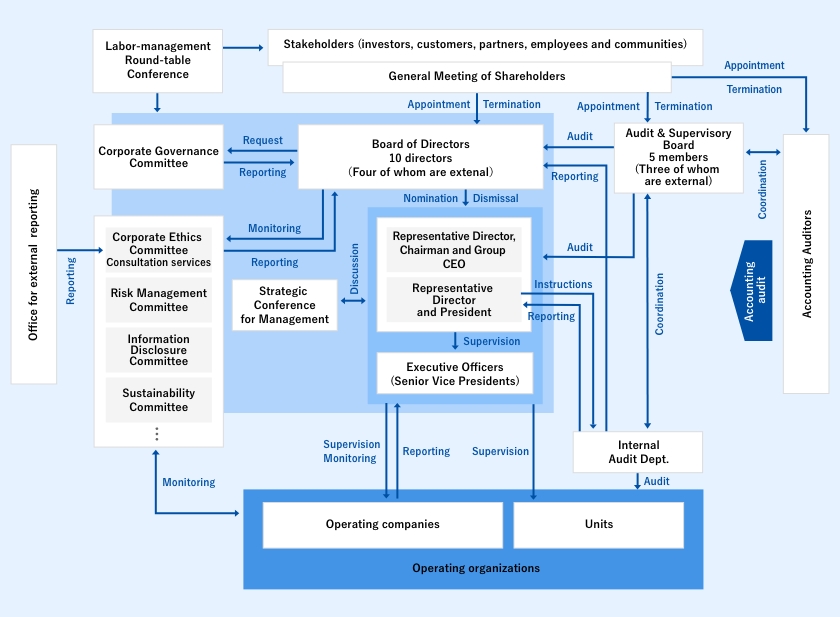

Corporate Governance Structure

As the holding company, the Company clarifies the management responsibilities in each business and develops an organizational structure for accelerating management decision-making, enhancing the function of business execution and strengthening the management oversight function.

The Board of Directors continually ascertains the circumstances of the operating companies and receives explanations when necessary, as well as carries out quick and appropriate decision-making. The Company holds a Strategic Conference for Management comprising full-time Directors and Executive Officers (Senior Vice Presidents) of the Company for the purpose of working to share the management policy and management information of the Group and discussing medium-to long-term business strategies.

Corporate Governance Structure

Board of Directors

The Board of Directors is composed of 10 Directors (including 1 female Director), of whom 4 are Outside Directors. The Board of Directors, pursuant to the Regulations of the Board of Directors, is engaged in decision-making concerning fundamental management matters and important business execution, in addition to matters set forth in laws and regulations and the Articles of Incorporation, as well as the monitoring of business execution. The Company has introduced an Executive Officer (Senior Vice President) System for the purpose of strengthening supervisory functions of the Board of Directors and accelerating the execution of business, through the separation of management decisionmaking and supervision from the execution of business. There are 4 Outside Directors who have broad experience and considerable insight in business management and in respective fields of specialization. From their independent positions, they contribute to the improvement of management’s monitoring functions.

In fiscal year 2024, the Board of Directors focused on discussing initiatives for each strategic domain, core strategies centered on non-financial factors such as human capital and sustainability based on the 8th Mid-Term Management Plan (SMILE145) announced in May 2022, the planned development of senior management candidates, evaluation of the effectiveness of the Board of Directors, and the reduction of cross-shareholdings, among other matters.

Audit & Supervisory Board

The Audit & Supervisory Board is composed of 2 Audit & Supervisory Board Members and 3 Outside Audit & Supervisory Board Members. Its role is to engage in discussions and make decisions on important matters relating to its audit of the Company. Audit & Supervisory Board Members audit the compliance and validity of the Directors’ business execution by participating in the Board of Directors meetings and other important meetings. Outside Audit & Supervisory Board Members offer necessary advice, suggestions and opinions, making use of their broad experience and insight in business management and in respective fields of specialization.

In fiscal year 2024, the Audit & Supervisory Board mainly discussed the selection of full-time Audit & Supervisory Board members, the formulation of the audit policy and audit plan, and audit of the development and operational status of the internal control system, consent for the accounting auditor’s compensation, evaluation of the accounting auditor, audit of business reports, financial statements, etc., preparation of audit reports, and discussion on Key Audit Matters (KAM), and matters related to the appointment and compensation of Audit & Supervisory Board members.

Corporate Governance Committee

In order to enhance the objectivity and transparency of management, the Company has established the Corporate Governance Committee, in which Independent Outside Officers account for the majority of members, as an advisory body to the Board of Directors. The Committee deliberates on matters relating to compensation for Officers, nomination of Officer candidates including successor development plans, appointment and dismissal of senior management such as Representative Directors, and other matters regarding corporate governance from a fair and objective perspective, and reports to the Board of Directors.

In fiscal year 2024, the Corporate Governance Committee focused on deliberating the selection of candidates for Directors and other officers, as well as the succession plan. The Committee also discussed the amount of performance-linked compensation to be paid to officers according to their positions.

Chairperson |

Shinji Hattori |

|---|---|

President |

Shuji Takahashi |

Independent Outside |

Noboru Saito |

Independent Outside |

Hideki Kobori |

Independent Outside |

Masahiko Uotani |

Independent Outside |

Shihoko Urushi |

Independent Outside |

Hideki Amano |

Independent Outside |

Masatoshi Yano |

Independent Outside |

Kenji Sakurai |

Chairperson |

Shinji Hattori |

|---|---|

President |

Shuji Takahashi |

Independent Outside |

Noboru Saito |

|---|---|

Independent Outside |

Hideki Kobori |

Independent Outside |

Masahiko Uotani |

Independent Outside |

Shihoko Urushi |

Independent Outside |

Hideki Amano |

|---|---|

Independent Outside |

Masatoshi Yano |

Independent Outside |

Kenji Sakurai |

Corporate Ethics Committee

This committee was established with the aim of systematizing the Group’s corporate ethics and compliance policies so as to ensure consistent, fair, and appropriate business activities. The committee is chaired by the President, and its members include directors, executive officers, and others appointed by the chairman as necessary. The committee addresses and investigates cases reported through the helpline, compliance issues, response measures, and preventive measures. The committee holds regular meetings every six months to share information, and also conducts training sessions for officers and employees to promote awareness of and adherence to corporate ethics and compliance issues. The committee is continuously engaged in educational activities to ensure the fair and proper conduct of all Group business activities.

Risk Management Committee

The Company formed a Risk Management Committee, chaired by the President, to create and operate a risk management system. Each fiscal year the committee identifies significant risks for individual companies as well as those that need to be addressed across the entire Group. It also determines the departments responsible for these significant risks and instructs those departments to formulate and execute suitable response measures. In the event of a crisis, the committee promptly collects information, assesses the situation, and if necessary, establishes a crisis response headquarters to discuss and determine the steps needed to respond to the crisis. Additionally, to smoothly promote Group-wide initiatives on risk management through close collaboration and coordination between the Company and its subsidiaries, we established a Group Risk Management Committee. This committee consists of representatives from each Group company and provides a framework to confirm and share Group-wide risks, as well as sharing information on how to prevent risks and proper response measures.

Financial Audit

The Company undergoes financial audits conducted by KPMG AZSA LLC, a certified public accounting firm, in accordance with the Companies Act and the Financial Instruments and Exchange Act.

Internal Audit Department

The Internal Audit Department is responsible for internal auditing of the Company and its various business units. It evaluates the development and operation of the Group’s overall internal control system, and provides feedback on the results to ensure that business operations are conducted appropriately.

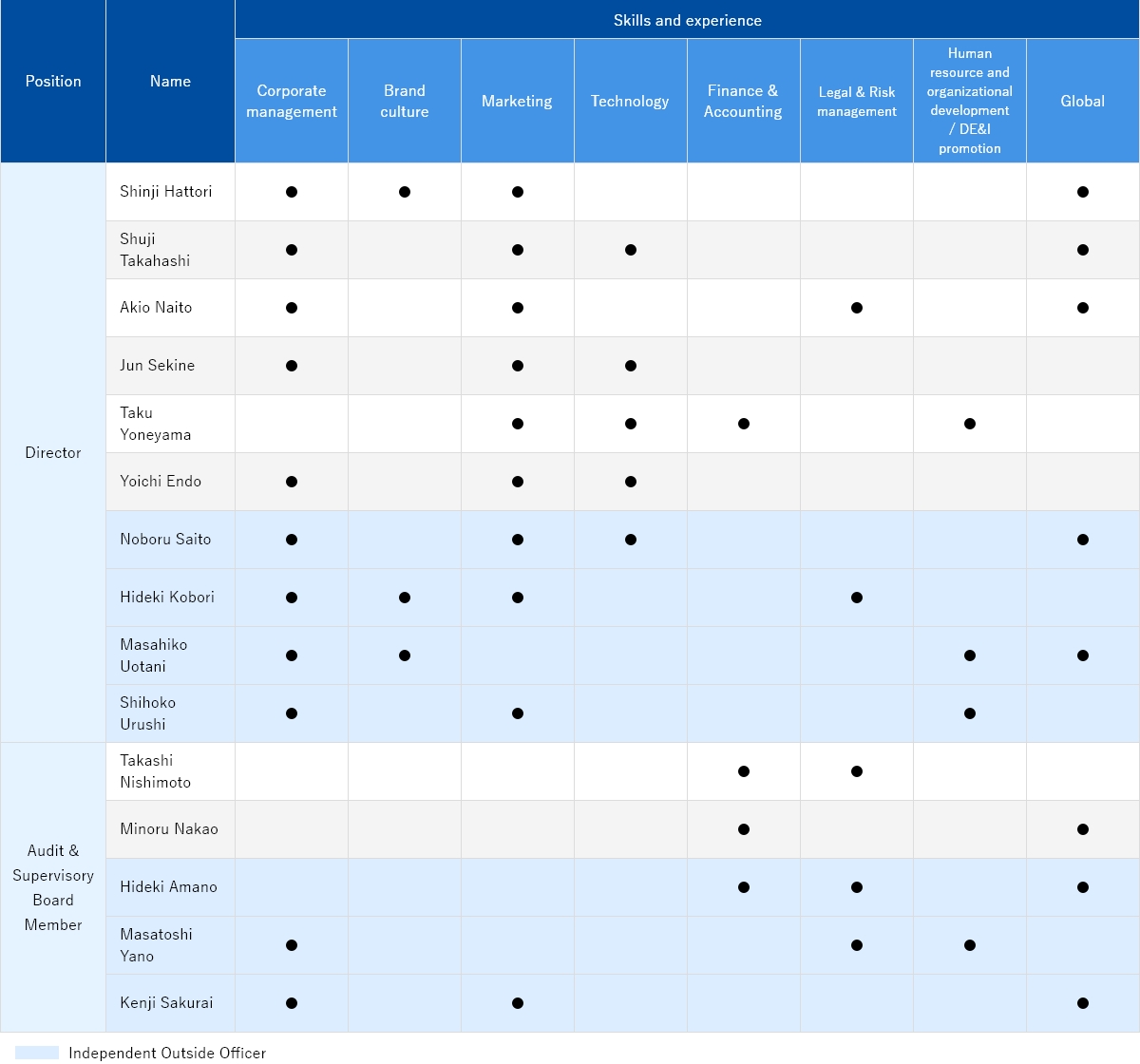

Skills Matrix for Directors and Audit & Supervisory Board Member

Evaluation of the Effectiveness of the Board of Directors

As part of efforts to strengthen and promote the corporate governance system, the Company has evaluated the effectiveness of the Board of Directors, based on its Basic Principle of Corporate Governance. The following is a summary of the results of the evaluation.

Analysis and Evaluation Methods

All Directors and Audit & Supervisory Board Member were asked to fill out a questionnaire regarding the effectiveness of the Board of Directors, and replies were collected from all of them. The responses received were aggregated and analyzed by an outside consultant while ensuring anonymity.

The questionnaire was prepared based on initiatives and discussions on the Company’s corporate governance to date, and the evaluation items 1 to 5 as below were set.

- The status of deliberations and operation of the Board of Directors

- The composition and roles of the Board of Directors

- The support system for Outside Officers

- The Corporate Governance Committee*

- Relationships with investors and shareholders

* Corporate Governance Committee

The Company establishes the Corporate Governance Committee where independent outside officers account for the majority of members, as an advisory body for the Board of Directors on matters such as nomination of officer candidates, compensation for officers, and other issues relating to corporate governance.

The analysis was conducted by the external consultant based on the above process and content, and the results were reported to the Board of Directors. By using them as a reference, the Board of Directors conducted an evaluation of its effectiveness and confirmed future measures.

Summary of Evaluation Results

According to the results of the evaluation above, it was confirmed that the Board of Directors of the Company was functioning properly and its effectiveness had mostly been assured. As for the issues raised in the previous fiscal year, due to taking the following measures, improvements to issues were confirmed.

| Issues in the Previous Fiscal Year | Status of Measures |

|---|---|

| (1) Further shortening of time spent on giving explanations and enhancing time for deliberation at Board of Directors meetings |

Following items have been established as rules: ・to create an executive summary of materials for the Board of Directors meetings ・to clearly distinguish main materials and reference materials for the Board of Directors |

| (2) Further strengthening of overseas IR activities | IR activity plan, including overseas IR activities, was reported to the Board of Directors and discussions were conducted aimed at further strengthening overseas IR activities. |

This Fiscal Year’s Initiatives

Based on the above results of the evaluation, opinions were expressed by Directors and Audit & Supervisory Board Member calling for further enhancement of deliberation time of the Board of Directors, promotion of strengthening information sharing, and collaboration with Outside Officers. Therefore, the Company has set these as this fiscal year’s initiatives and aim to further improve the effectiveness of the Board of Directors.

The Company will strive to further strengthen its corporate governance system by addressing the above initiatives.

Support system for Directors and Audit & Supervisory Board Member

The Company deliberates on, mediates, and provides monetary support for the necessary preparation and guidance, such as seminars conducted by outside organizations, for Directors and Audit & Supervisory Board Member, at the time of their appointment and thereafter, in order for them to acquire the knowledge and information needed to fulfill their roles and responsibilities. As part of providing information to Outside Directors and Outside Audit & Supervisory Board Member, the Company invites them to attend inspection tours of an exhibition of watches which proposes a collection of new products and examples of merchandise on display at stores and to visit customer watch retailers, as well as its business locations, and holds Independent Outside Officers’ Opinion Exchange Meetings.

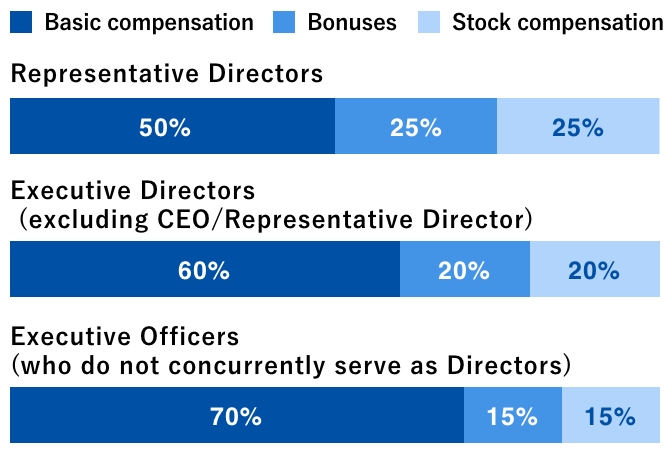

Compensation for Officers

Basic Policy of the Compensation for Officers

For determining compensation for officers of the Company, the basic policy is as follows:

・To ensure transparency and objectivity of compensation as well as to set the compensation level appropriate for their roles and responsibilities.

・ To encourage the execution of duties in line with the management philosophy and the management strategy, and to motivate the achievement of management objectives, in order to achieve sustainable growth of the Company and the Group and to enhance corporate value in the mid to long term.

The level of compensation for officers is determined based on results of the survey on compensation for officers by third parties targeting similar companies in terms of business contents and scale, etc.

Compensation System for Officers

Compensation for Directors who execute business duties consists of “basic compensation” which is a fixed compensation, and “bonuses” (short-term incentive compensation) and “stock compensation” (mid- to long-term compensation), which are performance-linked compensation.

Performance indicators related to performance-linked compensation shall consist of the significant management indicators set forth in the 8th Mid-Term Management Plan (SMILE145) for the five (5) years from fiscal year 2022 to fiscal year 2026.

| Type of compensation, etc. | Policy for determining the contents and amounts of compensation, etc. | Performance indicators | |

|---|---|---|---|

Fixed |

Basic compensation |

Basic compensation shall be monthly fixed compensation. The amount shall be determined by taking into account comprehensive factors, while considering the level of peer companies and the length of service, etc., according to their roles and responsibilities. |

- |

Performance-linked compensation, etc. |

Bonuses |

For bonuses, a standard payment shall be the amount obtained by multiplying the basic compensation by a coefficient determined for each position. The individual payments for Chairman and President shall be determined by multiplying the standard payment by the payment ratio according to the performance achievement ratio. The individual payments for Executive Directors other than Chairman and President and Executive Officers (Senior Vice Presidents) shall be determined by adding the amounts obtained by multiplying the standard payments by the payment ratio according to the performance achievement ratio, to the amounts obtained by multiplying the standard payments by the payment ratio based on qualitative evaluations. Bonuses shall fluctuate in the range of 0 to 200% depending on the degree of achievement of the target values. |

①Consolidated operating profit |

Stock |

For stock compensation, points obtained by converting the individual benefits into the number of shares shall be granted each fiscal year. The individual benefits shall be the amounts determined by adding the standard benefits (fixed portion) obtained by multiplying the basic compensation by a coefficient determined for each position, to the amount obtained by multiplying the standard benefits by the payment ratio based on financial and non-financial (ESG) evaluations (performance-linked portion). The performance-linked portion of the stock compensation shall fluctuate in the range of 0 to 200% depending on the degree of achievement of the target values. The guideline for the ratio of the fixed portion and the performance-linked portion shall be 50%, respectively (when the performance achievement ratio is 100%). |

①Consolidated operating profit |

|

Compensation Ratio of Each Type

With regard to the compensation ratio of each type for Executive Directors and Executive Officers (Senior Vice Presidents), the level of peer companies shall be considered so that it will be an appropriate ratio as an incentive to contribute to the enhancement of the corporate value of the Company. After being deliberated on by the Corporate Governance Committee, a majority of the members of which are independent outside officers, as an advisory body for the Board of Directors, the said policy shall be determined at the Board of Directors based on the deliberations. The guideline for the compensation ratio of each type shall be shown on the right (when the performance achievement ratio and the payment ratio based on qualitative evaluations are 100%):

Appointment and Dismissal of Senior Management and Nomination of Candidates for Directors and Audit & Supervisory Board Member

The Company believes that it is essential that candidates for senior management, Directors and Audit & Supervisory Board Member have the character and knowledge suitable for their respective duties. Based on this concept, in the appointment of senior management and the nomination of candidates for internal Directors, comprehensive consideration is given from the standpoint of appointing the right person for the right position, so that talent is appointed in a well-balanced manner to cover functions of the Company as a holding company as well as the Group’s business fields, while ensuring accurate and timely decision-making.

In the nomination of candidates for internal Audit & Supervisory Board Member, comprehensive consideration is given from the standpoint of whether the candidate possesses knowledge of the Group’s businesses as well as insight regarding finance, accounting and legal affairs, and whether the candidate can contribute to ensuring the soundness of management.

In the nomination of candidates for Outside Directors, comprehensive consideration is given from the standpoint of whether the candidate possesses abundant experience and high degree of knowledge of corporate management and specific fields.

In the nomination of candidates for Outside Audit & Supervisory Board Member, comprehensive consideration is given from the standpoint of whether the candidate possesses insight regarding finance, accounting and legal affairs, as well as abundant experience and high degree of knowledge of specific fields.

Based on the above policy, the Board of Directors determines the candidates proposed by the Representative Directors, upon deliberation by the Corporate Governance Committee, the majority of which comprises independent Outside Officers. In addition, with regard to the dismissal of senior management, in situations in which dismissal standards determined by the Board of Directors apply, such as when senior management is not fully fulfilling his or her function in light of evaluations including the Company’s performance, the Corporate Governance Committee conducts deliberations in a timely manner, and the Board of Directors, based on the results of such deliberations, determines the dismissal of senior management.

Cross-Shareholdings

From the perspective of improving the corporate value of the Group in the mid- to long-term, the Company has a policy to reduce shares that are deemed not to have a significance of holding them, taking comprehensively into consideration the Company’s management strategy, business relationships with clients, and the benefits and risks, etc., associated with holding in view of its capital cost.

The Company’s Board of Directors verifies each year the rationale for the holding of all listed shares held in cross-shareholding by the Group through examination of the importance of the issuer as a business partner and benefits and risks of shareholding in light of capital costs and other factors. Most recently, an individual verification was conducted at the meeting of the Board of Directors held in September 2025.

With regard to certain shares, which were determined to be of no significance or lacking in rationale to justify their continued holding, the Company is proceeding with discussions toward their disposal.

Based on the above policy on cross-shareholdings, the Company sold a portion of its cross-shareholdings and one stock among the cross-shareholdings held by a subsidiary in fiscal year 2024.

Standards for Exercising Voting Rights on Cross-Shareholdings

With regard to the exercise of voting rights on cross-shareholdings, the Company exercises its voting rights, upon fully respecting management policies and strategies, etc. of the issuing company, by comprehensively determining on whether the proposal contributes to the sustained growth and the mid-to long-term enhancement of corporate value of the issuing company, and whether or not it undermines shareholder value, among other factors. In addition, in making such decisions for particularly important proposals, the Company holds dialogue with the issuing company, as necessary. The proposals deemed important by the Company are as follows.

- Proposals on appointment of Directors and Audit & Supervisory Board Member

- Proposals on reorganization of corporate structure including mergers

- Proposals on takeover defense measures

- In addition to the above, proposals that may undermine shareholder value

Internal Control System

The Company, in accordance with its basic policy on the internal control system, has established a Group-wide internal control system, including the Group’s business management, corporate ethics, compliance with laws and regulations, risk management and internal audits. Furthermore, the Company monitors the operation status of internal controls and periodically reports the results to the Board of Directors.