Seiko's Purpose

As a company trusted by society, we will constantly pursue innovation, inspiring people everywhere, and creating a future full of smiles.

World Athletics Championships

Tokyo 25

Tokyo 2025

World Athletics Championships

In 2025, the world’s top athletes will gather in Tokyo to compete for the title of “best in the world” in their respective events.

And Seiko will be there to capture every exciting moment.

As always, we are working together with World Athletics to ensure that we not only capture, but also preserve the new records we hope to see set.

until the opening of the Tokyo 2025 World Athletics Championships

000d 00h 00m 00s

Pick Up Contents

Introducing Initiatives of the Seiko Group

Business & Products

Value Creation:

Business & Products

Cherishing the great trust built up with our stakeholders since our founding, we provide profitable, high-value-added products and services to our customers and to society as a whole.

Sustainability

Sustainability Initiatives

We pledge to contribute to the growth of our Group and to the development of a sustainable society.

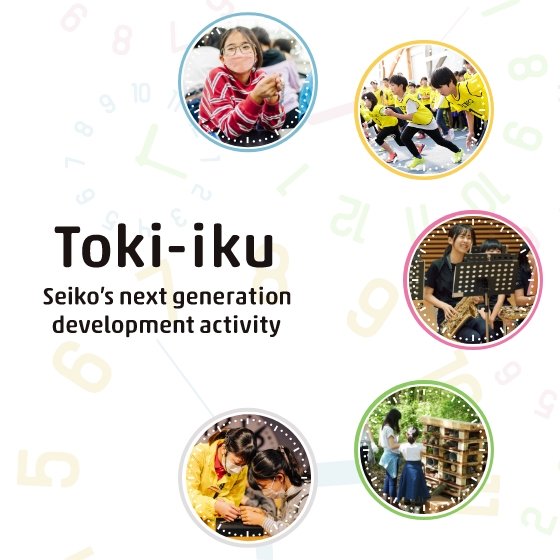

Learning about Time,

creating the future

Seiko’s Next-Generation Nurturing Activity

「Toki-iku」

We are engaged in activities to help the next generation learn about the importance of “Time” and develop their ability to think independently.

Branding

For a Future Filled with Smiles

Through sports, we hope to inspire people, to support individual growth worldwide, to bring smiles to the next generation, and to share the wonders of Japanese culture. We are on an endless journey to create a future filled with smiles.

NEWS

News・Release

- ALL

- Seiko

Group Corporation - Affiliated Companies

- IR